A Lack of Real Estate Development Capacity?

But Supply and Demand…

One of the key profit-maximizing tactics of monopolies, cartels and oligopolies is to restrict supply or output to either increase prices or prevent a decrease in prices. One well known current example of this is OPEC (Organization of Petroleum Exporting Countries) . OPEC members produce over 50% of the World’s supply of oil. Their members have enough market share to influence the current market price of oil by restricting or increasing output.

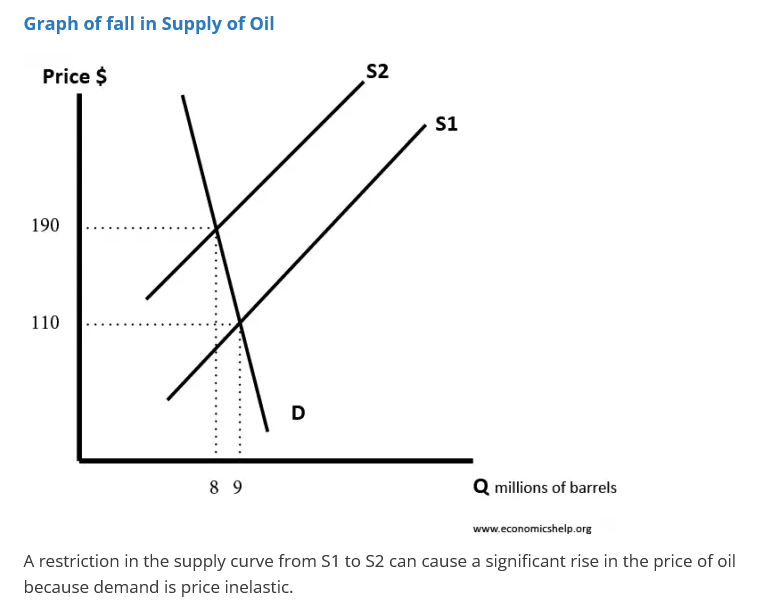

See chart below from the same article:

In this example, OPEC can agree to reduce oil supply from 9 to 8 million barrels and could see the price per barrel increase from $110 to $190. This would increase total revenue to $1.5B from $995 ((8,000,000 * $190 vs 9,000,000 vs $110)). That’s a good deal – less work for more money.

How Can They Do This?

Beyond a large market share, at least two other conditions need to be met for a firm or group to be able to restrict supply and increase prices and profits:

- Demand and consumption must be price inelastic.

This means if the price goes up, the demand or consumption doesn’t change at all, or only changes just a little. Oil is absolutely like that. If it’s February, -30 C and you need a tank of oil, you pay what it costs for the tank of oil.((The nuance is maybe you don’t buy a whole tank now. But you will need to buy enough oil to heat your house throughout winter.)) Compared to something like a pizza. If you consume a lot of pizza and the price doubles, you can easily replace pizza with a different, less expensive food. To do this for the oil, you’d first have to spend money to replace your home’s heating system. ((This is my simplified description of price inelasticity. I suspect economists will point out what I’m missing.))

- Significant barriers to entry for new competitors

To get started in the oil industry, first you need land that has oil. Then you need the capital and expertise to access that oil. It’s nearly impossible to get all three if you’re not in the industry. Compare that to pizza parlours, there aren’t many barriers to entry in the pizza market. If Dominos tried to reduce the supply of pizza pies in a city in order to drive up the price, someone would come along and open up a new shop and start selling pizzas.

How does this relate to housing?

The approach of the last 25 years is for the Federal/Provincial programs to partner with developers or non-profits to increase the supply of housing. The government provides funding, through grants or cheap financing, and the private/non-profit sectors provide the expertise to build housing. The theory is that this partnership will increase the supply of market and non-market housing, which will then make housing affordable again.

This sounds great, and makes sense in theory.

But. what if the real estate development industry has similar characteristics and market power to the ones outlined above when describing OPEC?((Concentration of the Real Estate Development industry isn’t tracked because most of this industry is local, with some national REITs and developers.))

If that is true, what if the development industry has the power and incentives to control supply to maximize their profits and asset values? ((Full disclosure: I am in the Real Estate Industry, and this would have an impact on me directly. However, I am more worried about what happens to our communities if we don’t solve the housing crisis. Also – no one in Canada should be un-housed simply because of money.)) ((I haven’t studied math in a long time, but if you keep building housing with above average prices, you can’t decrease the average price. Correct?))

Let’s work backwards:

Are there significant barriers to entry for new competitors in the real estate development industry?

Yes – absolutely. The first barrier to entry is land. You can’t just magically build houses or apartments on land you don’t own or is already occupied. s. There is only a finite amount of land, especially in urban centers. If a new competitor can’t access land, they can’t enter the market.

Access to land is also closely tied to access to capital.

Even if a piece of land is available a developer needs to have the capital to buy it outright, or the developer needs access to financing.

The capital requirements don’t stop there.

If the developer finances the land, they need to have the cash flow or capital to make the payments while the project is in planning and under development.

On top of those payments, the developer needs the money to pay for all the planning work and consultants, such as the engineers, the designers, the surveyors, etc.

Once they’ve done all this, they need the capital to build any infrastructure the project requires. ((This would be sewer/water pipes, streets, sidewalks, etc )) Again, these costs can be financed, provided the developer has a way to make these loan payments.

After the land is purchased, the designs are complete, and the infrastructure built, capital is needed to execute the project.

To build an apartment building lenders typically require 20% of the construction costs as a down payment and will finance the rest through a mortgage. To build properties to sell, lenders typically require 10-20% as a down payment and will finance the remainder.

It’s real estate so there are lots of financing options available from banks, mortgage companies, private money, hard money, etc.

But, what’s one of the first things potential lenders look at when evaluating a project?

The previous track record of the developer.

This means it’s easier to secure financing if you have previous experience in developing real estate.

How does a developer gain this experience?

By being in the industry.

Barriers to entry – check.

If the price of housing increases will people buy or use less of it? (Is the price inelastic?)

For my simple analysis,((Again this my simplistic view of the price elasticity of real estate. It is more nuanced than this, and someone could probably make an argument that actually no real estate demand will go demand if prices go up. I’m not seeing that. I’m sure that someone will send me papers or economic analysis showing I’m wrong. Please do. I’m curious to hear your arguments.)) I’m going with no people won’t use less housing if the price increases. People always need a place to live though they may adjust where they liuve. If someone is priced out of downtown Halifax they may move to the suburbs, or they may move to a smaller apartment or house. When prices increase people can choose to live somewhere else, they can’t choose to not have a house or place to live.

Do development firms have the market power to limit supply and maintain/increase prices?

This is a tricky question to answer. I don’t know if anyone has looked at the market power of real estate developers because historically this has been a local industry. Only in the last 20-30 years have REITs and large investment companies started developing across the country.

Luckily the data to evaluate the market power and concentration of local real estate developers exists. Municipalities have all the building permit data and new subdivision applications. Plus mortgage information, land ownership, development agreements, and more property data is all public record. If municipalities don’t want to do this, academics or other researchers could access this data to complete this research.

What questions to answer:

The data and information I’d like to compile are:

- What percentage of apartments or condos were built by which developers over the last 10, 15 or 20 years?

This would show market share of each developer and could highlight potential market power issues.

- What percentage of new subdivisions were built by which developers over the last 10, 15 or 20 years?

I would look at land development separate from apartments and condo development. Again this will show market share of each developer and could highlight potential market power issues.

- Create a narrative descriptions of each developer

I would identify information about each developer such as the age of the business, history, background, etc, etc. This will give a sense if there are barriers to entry in the marketplace. If there aren’t any barriers to entry there should be a significant percentage of new and smaller developers. If there are barriers to entry then most developers should be well-established local businesses,large businesses from other cities, or well-financed new entrants.

- Plot the number of apartments/condos built by each developer by year over the last 10, 15 or 20 years.

A graph like this should show if there has been a reduction in developers in this market over the period of time. This could show excessive consolidation in the industry and could explain any market power issues identified in point 1.

- Plot the number of new lots built by each developer by year over the last 10,15 or 20 years.

A graph like this should show if there has been a reduction in developers in this market. This could show excessive consolidation in the industry, and could explain any market power issues identified in point 2.

Purpose of this investigation?

We could be in a situation where some developers have the market power to control supply, and the incentives to do so in order to keep real estate values high. If this is true, our current strategy to fixing the housing crisis by partnering with developers could require them to act against their own self-interest.

If this is true, municipalities and other governments may need to then identify ways to bring more competition into the real estate development world. This may involve the Federal Government building large numbers of public housing again.

Waiting on developers to act against their own self-interest and increase the supply of housing –sadly may never happen.

Member discussion