The Missing Middle?

I’ve been writing and thinking about how consolidation and monopolies have contributed to our affordable housing crisis. I wrote about potential consolidation in the building supply material possibly increasing the cost of construction. Then I wrote about possible consolidation in the insurance industry causing excessive premium increases.

I’ve thought these two points create a negative feedback loop for housing costs. Basically if construction costs are artificially high then it costs too much to resolve any insurance claims. Without sufficient competition the insurance industry can always pass on these costs as higher premiums and we can’t do anything about it.

I started to think more about our history dealing with our insurance company. We’ve had two large water damage claims in all of our properties. Each time we called our insurance company to file a claim. Our insurance company then sent the file to an independent claims adjuster to manage the whole claim.

I don’t know much about independent insurance adjusters and decided to look more in to them.

But first another a random thought from me.

Too big, but not big enough?

Three years ago I said to my father that our business was too big, but not big enough. I felt like we were stuck in the middle. We were big enough that we started to run into the larger players, but we weren’t big enough to actually compete with them. We were starting to get pushed around by some of our key suppliers, but we weren’t big enough to be able to fight back.

We had to keep growing to acquire more power just so we could keep up as other companies consolidated. We weren’t just competing with real estate companies as they consolidated and grew. We had to grow and acquire power to protect ourselves from our suppliers such as insurance, social media companies, software providers, telecommunication companies, amongst others.

We had to decide; grow significantly, or decrease in size.

We made the decision to keep growing.

The Missing Middle?

I can’t be the only business that’s felt this pressure to either grow or shrink. Based on this experience, I’ve thought a sign of a consolidated industry is a lack of locally owned medium-sized companies.((The Missing Middle is a concept from Affordable Housing research. In the case of Toronto to refers to most housing either being single family deatached houses, or apartments in high rise buildings. There’s little in between these two. I find this concept applies to business extremely well too. There are a lot of large business, and a lot of small businesses, but not many medium-sized businesses anymore.))

My theory is consolidation in the insurance industry should lead to consolidation in related industries, such as Independent Insurance Adjusters. ((This isn’t based on academic research, just my anecdotal experiences. If anyone has this research please send it along.))

Independent Insurance Adjusters in NS:

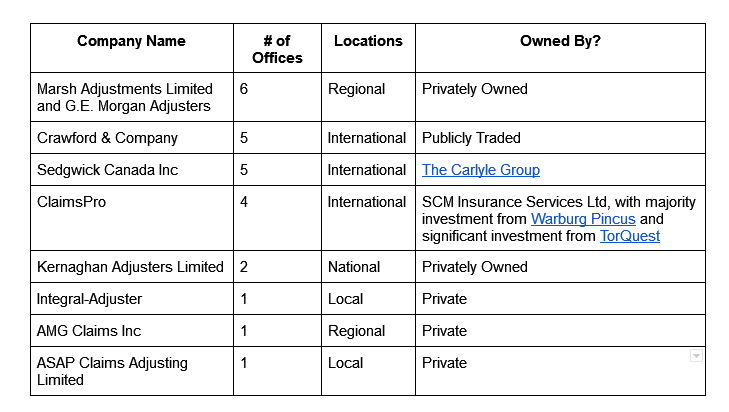

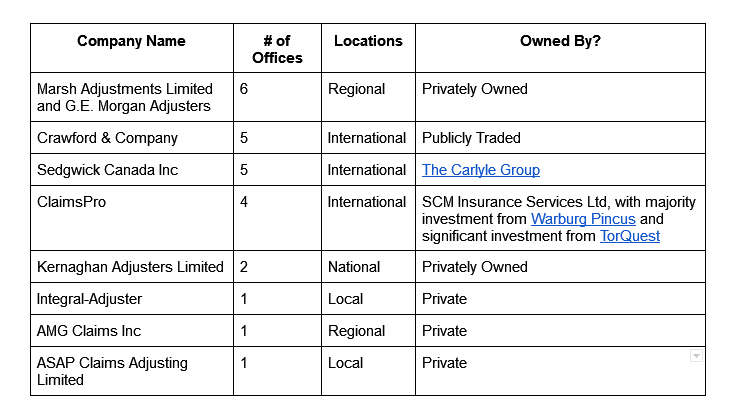

Insurance adjusters are regulated by each province. The Canadian Independent Adjusters’ Association lists 25 offices for independent insurance adjusters in Nova Scotia. 25 seems to be a lot of competition, but with a quick analysis it’s not.

I compiled each company by how many offices it had in NS, what regions the company operated in, and who owns the company.

I found the following:

80% (20 of 25) of the branches are owned by four companies. One company is privately and locally owned. The other three are large international companies that are publicly traded or backed by private equity money((Private Equity involvement is another sign I look for when trying to identify consolidated industries.)). I don’t have the transaction volumes for each company, I suspect that data would show the revenues of the three international companies would dwarf the revenue of the regional company.

Looking at the chart there are:

3 small local companies

1 medium locally owned company

4 large national and international companies

The lack of medium sized companies shows potential signs of consolidation in the independent adjuster industry. I suspect this consolidation is a reaction to the potential consolidation in the insurance industry. ((This is not a definitive analysis, but points to more research and analysis is needed.))

What is the impact of this?

A lack of competition leads to higher prices. This means a lack of competition in the insurance adjuster space can lead to higher costs to resolve insurance claims. These excess costs then get passed on to property owners as higher insurance premiums, making housing unaffordable or less affordable for all of us.

What can we do?

Mandate maximum increases in homeowner and property insurance.

In 2003 the NS Government mandated maximum increases in automobile insurance. Maybe this needs to be done for property and homeowner policies now.

Move some competition regulation to provincial jurisdictions or have regional competition bureau offices to investigate smaller cases in each region of our province.

Investigate the health of the insurance industry then act if a lack of competition is found act.

Ban all mergers related to the insurance industry no matter the size.

Member discussion